dynsimimplements Williams and Whitten's (2012) method for dynamic simulations of autoregressive relationships. Building on work by King, Tomz, and Wittenberg (2000),dynsimdepicts long-run simulations of dynamic processes for a variety of substantively interesting scenarios, with and without the presence of exogenous shocks.The software package is available for both R and Stata. The general functionality is the same for the two versions of the software, though the syntax differs. The examples below illustrate how to use the different versions of the package.

The examples are drawn directly from Gandrud, Williams, and Whitten (working paper) for the R version and Williams and Whitten (2011) for the Stata version.

Version 1.0

Process

There are four basic steps to use dynsim to create dynamic simulations of autoregressive relationships:

Estimate your linear model using

lmor similar functions.Set up starting values for simulation scenarios and (optionally) shock values at particular iterations (e.g. points in forecasted time).

Simulate these scenarios based on the estimated model using the

dynsimfunction.Plot the simulation results with the

dynsimGGfunction.

Examples

To see how dynsim works, let's go through a few examples. We will use the Grunfeld (1958) data set. It is included with dynsim.

First let's load the packages we will use:

library(dynsim) library(DataCombine)

Now let's load the data:

data(grunfeld, package = 'dynsim')

The linear regression model we will estimate is:

\[I_{it} = \alpha + \beta_{1}I_{it-1} + \beta_{2}F_{it} + \beta_{3}C_{it} + \mu_{it} \]where \(I_{it}\) is real gross investment for firm \(i\) in year \(t\). \(I_{it-1}\) is the firm's investment in the previous year. \(F_{it}\) is the real value of the firm and \(C_{it}\) is the real value of the capital stock.

In the grunfeld data set real gross investment is denoted invest, the firm's market value is mvalue, and the capital stock is kstock. There are 10 large US manufacturers from 1935-1954 in the data set. The variable identifying the individual companies is called company. We can easily create the investment one-year lag using the slide command from the DataCombine package. Here is the code:

grunfeld <- slide(grunfeld, Var = 'invest', GroupVar = 'company', NewVar = 'InvestLag')

The new lagged variable is called InvestLag.

Dynamic simulation without shocks

Now that we have created our lag variable we, can begin to create dynamic simulations with dynsim by estimating the underlying linear regression model:

M1 <- lm(invest ~ InvestLag + mvalue + kstock, data = grunfeld)

We can use the resulting model object M1 in the dynsim command to run our dynamic simulations. We first need to create a list object containing data frames with starting values for each simulation scenario. Imagine we want to run three contrasting scenarios with the following fitted values:

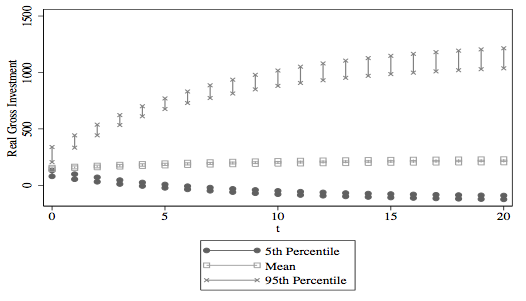

- Scenario 1: mean lagged investment, market value and capital stock held at their 95th percentiles,

- Scenario 2: all variables held at their means,

- Scenario 3: mean lagged investment, market value and capital stock held at their 5th percentiles.

We can create a list object for the scen argument containing each of these scenarios with the following code:

# Create simulation scenarios attach(grunfeld) Scen1 <- data.frame(InvestLag = mean(InvestLag, na.rm = TRUE), mvalue = quantile(mvalue, 0.95), kstock = quantile(kstock, 0.95)) Scen2 <- data.frame(InvestLag = mean(InvestLag, na.rm = TRUE), mvalue = mean(mvalue), kstock = mean(kstock)) Scen3 <- data.frame(InvestLag = mean(InvestLag, na.rm = TRUE), mvalue = quantile(mvalue, 0.05), kstock = quantile(kstock, 0.05)) detach(grunfeld) # Combine into a single list ScenComb <- list(Scen1, Scen2, Scen3)

In this example we won't introduce shocks, so now we run our simulations:

Sim1 <- dynsim(obj = M1, ldv = 'InvestLag', scen = ScenComb, n = 20)

This took 1000 draws of the coefficients to produce 20 dynamic simulation iterations for each of the three scenarios. In the resulting Sim1 object we have retained the middle 95% and 50%. We will return to presenting and exploring the contents of Sim1 later.

Dynamic simulation with shocks

Now let's include fitted shock values. In particular, let's see how a company with capital stock in the 5th percentile is predicted to change its gross investment when its market value experiences shocks compared to a company with capital stock in the 95th percentile. We will use market values for the first company in the grunfeld data set over the first 15 years as the shock values. To create the shock data use the following code:

# Keep only the mvalue for the first company # for the first 15 years grunfeldsub <- subset(grunfeld, company == 1) grunfeldshock <- grunfeldsub[1:15, 'mvalue'] # Create data frame for the shock argument grunfeldshock <- data.frame(times = 1:15, mvalue = grunfeldshock)

Now we can simply add grunfeldshock to the dynsim shocks argument.

Sim2 <- dynsim(obj = M1, ldv = 'InvestLag', scen = ScenComb, n = 15, shocks = grunfeldshock)

Now we can simply add grunfeldshock to the dynsim shocks argument.

Sim3 <- dynsim(obj = M1, ldv = 'InvestLag', scen = ScenComb, n = 15, shocks = grunfeldshock)

Plotting simulations

Probably the easiest and most effective way to communicate your dynsim simulation results is with the package’s built-in plotting capabilities. These are accessed with the dysnsimGG command. Let’s start by plotting the simulations from our basic model. In an earlier example we put these results into Sim1. Using dynsimGG's default settings we can plot the simulations with the following code:

dynsimGG(Sim1)

We can make a number of aesthetic changes. For example, we can re-title the legend using the leg.name argument and change the legend values by adding a vector of the desired label names in the order of our scenarios using the leg.labels argument. We can also change the color palette using the color argument. Let’s use the 'orange-red' palette denoted by OrRd. Finally, we can change the y-axis label with the ylab argument so that it is more descriptive.

# Create legend labels vector Labels <- c('95th Percentile', 'Mean', '5th Percentile') # Plot dynsimGG(Sim1, leg.name = 'Scenarios', leg.labels = Labels, color = 'OrRd', ylab = 'Predicted Real Gross Investment\n')

Plotting simulations with shock variables is very similar to what we have already seen. The one major change we can make is to include a plot of one shock variable’s fitted values underneath the main plot. To do this simply use the shockplot.var argument to specify which variable to plot. Use the shockplot.ylab argument to change the y-axis label. For example:

dynsimGG(Sim2, leg.name = 'Scenarios', leg.labels = Labels, color = 'OrRd', ylab = 'Predicted Real Gross Investment\n', shockplot.var = 'mvalue', shockplot.ylab = 'Firm Value')

Similarly, we can plot the simulations from scenarios where market value shocks were interacted with capital stock. The code is accomplish this is almost identical to the code chunk we just saw. The only difference is that we use the Sim3 model object.

dynsimGG(Sim3, leg.name = 'Scenarios', leg.labels = Labels, color = 'OrRd', ylab = 'Predicted Real Gross Investment\n', shockplot.var = 'mvalue', shockplot.ylab = 'Firm Value')

Install

dynsim for R is available on CRAN.

You can also easily install the latest development version with devtools package:

devtools::install_github('christophergandrud/dynsim')

The Stata Examples section is under development.

For more information about the Stata version of dynsim please see Williams and Whitten's (2011).

Examples

To see how dynsim works, let's go through a few examples. We will use the Grunfeld (1958) data set. You can download it with: webuse grunfeld.

The linear regression model we will estimate is:

\[I_{it} = \alpha + \beta_{1}I_{it-1} + \beta_{2}F_{it} + \beta_{3}C_{it} + \mu_{it} \]where \(I_{it}\) is real gross investment for firm \(i\) in year \(t\). \(I_{it-1}\) is the firm's investment in the previous year. \(F_{it}\) is the real value of the firm and \(C_{it}\) is the real value of the capital stock.

In the grunfeld data set real gross investment is denoted invest, the one-year lag of this variable is lag_invest, the firm's market value is mvalue, and the capital stock is kstock. There are 10 large US manufacturers from 1935-1954 in the data set. The variable identifying the individual companies is called company.

We start by using estsimp to simulate 1,000 draws of each coefficient.

estsimp reg invest lag_invest mvalue kstock

We then use dynsim to produce 20 dynamic simulations (using the option n(20)) of each of the three scenarios, with the resulting predicted values and 95% confidence intervals (the default, changeable via the sig option) saved to a data set named ''dynsim1'' in the working directory.

Suppose that we want to simulate three different scenarios based on holding the firm's market value and value of the capital stock at its 5th percentile, mean, and 95th percentile, respectively. To do this we use the scen options (in the Stata version you can set up to 4 scenarios). We can also provide the starting value for the lagged dependent variable (in the scen options), which in this case is the sample mean. Here is the code:

dynsim, ldv(lag_invest) scen1(lag_invest mean mvalue p5 kstock p5) scen2(mean) scen3(lag_invest mean mvalue p95 kstock p95) n(20) saving(dynsim1)

We can present the predicted values (and confidence intervals) in the new dynsim1 data set in a variety of ways. We have found that Stata’s twoway rcap is a simple way of demonstrating the predicted values and uncertainty. It gives us plots like this: